Warren Buffet once advised investors to, “never invest in a company you can’t understand.”

His point was that investors need to learn how to identify and value businesses within their “circle of competence” and stay away from the rest. Essentially, stay in your lane when it comes to investing. At Revel, we focus on investing in B2B because it’s what we know. The General Partners at Revel began their careers in Martech and understand B2B software platforms and marketplaces because we helped pioneer selling software into enterprises with MarTech over a decade earlier.

The MarTech revolution demonstrated the importance of supply and demand and the outsized impact technological components could have in transforming traditional enterprises by enabling them to more efficiently compete with the tech-first Amazon’s of the world. Data and AI enabled the digitization of advertising and streamlined how advertising was bought and sold. Now, we're seeing these same transformations across verticals where SaaS platforms are helping build new workflows, new markets and increase connectivity between clients and enterprises.

This rapid adoption of B2B SaaS platforms is particularly relevant in light of how well B2B performs when compared to B2C companies. The case for B2B investments is hard to ignore given not only investment upside but portfolio risk, as well.

B2B Businesses Have More Stable, Recurring Revenue

B2B businesses generally enjoy lower churn than their B2C counterparts as enterprise software is “high touch” involving many points of contact between the client and the platform. The result may be a longer sales cycle for B2B but a higher customer lifetime value (CLV), as well. B2B SaaS platforms also have a natural advantage once they’ve crossed the hurdle of being installed. The products naturally become more ingrained (and more essential) to enterprise functions as change management hurdles are overcome and opportunities for upsell increase. Retention is the key for B2B whereas B2C businesses often have to find new clients at a higher clip just to maintain high growth.

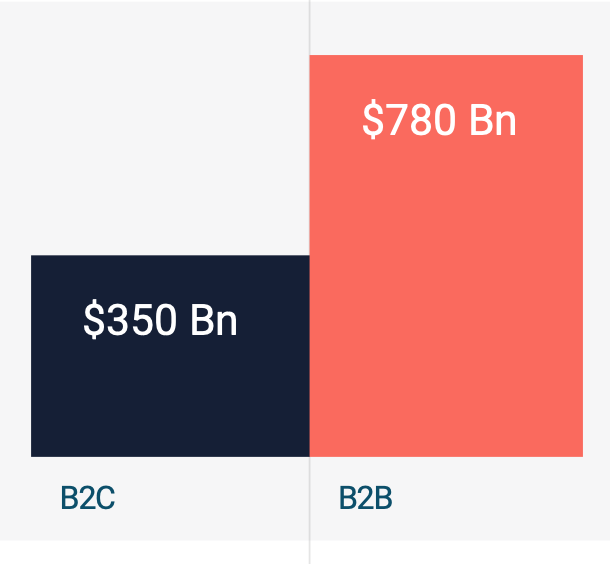

Additionally, while the target market for most B2C companies is larger, that doesn’t necessarily mean that there is more money to be made there. In fact, it’s estimated that the B2B market is valued at $780 billion versus $350 billion for the B2C market.

The motivations for B2B clients are entirely different than that which motivates the B2C customer. B2C motivators tend to focus on price, ease of use and flair. They tend to react to ephemeral consumer trends which are hard to identify and even harder to predict.

B2B business drivers are less fleeting and more concrete, driven by actionable/predictable business needs and by stakeholders in businesses that, in general, have much more money to spend than the average B2C consumer.

Finally, founders almost always come from the vertical they are building for and, as a result, are uniquely positioned to understand client motivations and needs as well as market pain points and opportunities.

While it may not seem like it from the outside, even companies that are famously consumer focused have B2B products that account for large percentages of their revenue.

Take Amazon, for example. While their eCommerce business might be the face of the brand, that segment of their business accounts for far less profit than their B2B products.

Amazon’s AWS product accounted for 71% of overall operating profits despite only being responsible for 13% of their total revenue. It is estimated that Amazon’s B2B ad business hauled in over $17 billion in sales in 2020!

Much like Amazon, Google is known for creating consumer products like Maps, YouTube, and Gmail. But their cloud products which are marketed towards enterprises represent a significant source of revenue. Their cloud business was on track to have a $10 billion run rate after the first quarter of 2020!

Recession Proof

B2B has also proven to perform better during recessions and times of crises. Given their sticky products and recurring revenues, B2B is marginally affected in hard times. Many investors treat this segment of companies as safe havens. Given the past 18 months this is particularly relevant.

Still Early

All of these factors have led to significantly higher return on invested capital, returning 15.5x vs 6.1x for B2C. Yet, even with the venture market catching up, B2B technology investment still trails B2C and remains a less competitive segment.

The verticalization of SaaS across all operating functions within the enterprise is rapidly approaching a tipping point. The average enterprise spends $6 million per year on enterprise platforms trying to keep up with the FAANG cohort and Be More Like Bezos. Technologies such as AI and Blockchain are being applied across marketplaces and in verticals as diverse as alternative investments, agriculture, retail and private debt. Enterprises are licensing technologies just to compete. Or, they’re simply buying up startups.

Over the next 5 years venture capital markets are going to get bigger, faster and more expensive. This will come on the heels of a record setting decade that saw an exponential surge in both dollars invested and rates of return. Significantly, Silicon Valley’s share of venture capital this year is also expected to drop below 20% for the first time ever and New York is stepping in to pick up share. In this diffuse and high-stakes environment, high growth companies that are both transformational and scalable are as desirable as they are hard to find and often come at a premium at later investment stages. Over the last decade the B2B category has come to epitomize value for investors hunting the next billion-dollar startup, particularly B2B SaaS platforms. B2B startups offer a higher return at a lower risk - particularly when compared with their B2C counterparts - and should continue to represent the best asset class profile for investors over the next 5-10 years.