By borrowing a page from AdTech, new Self Service health platforms are transforming the way enterprises choose and apply healthcare

One of the more significant happenings in healthcare right now is the transformation of employer-based health insurance. More and more enterprises are utilizing emerging technologies that leverage data and automation to effectively “unbundle” existing monolithic systems in healthcare, moving the system towards a more open, independent and transparent model.

If this all seems familiar it’s because it is.

The changes taking place in the healthcare system bear a striking resemblance to the transformations I witnessed firsthand when data and automation revolutionized advertising over a decade ago. Just as the application of data and automation upended the way media was managed and delivered to brands, these new platforms are fundamentally transforming the way healthcare is managed and delivered for 100’s of millions of Americans.

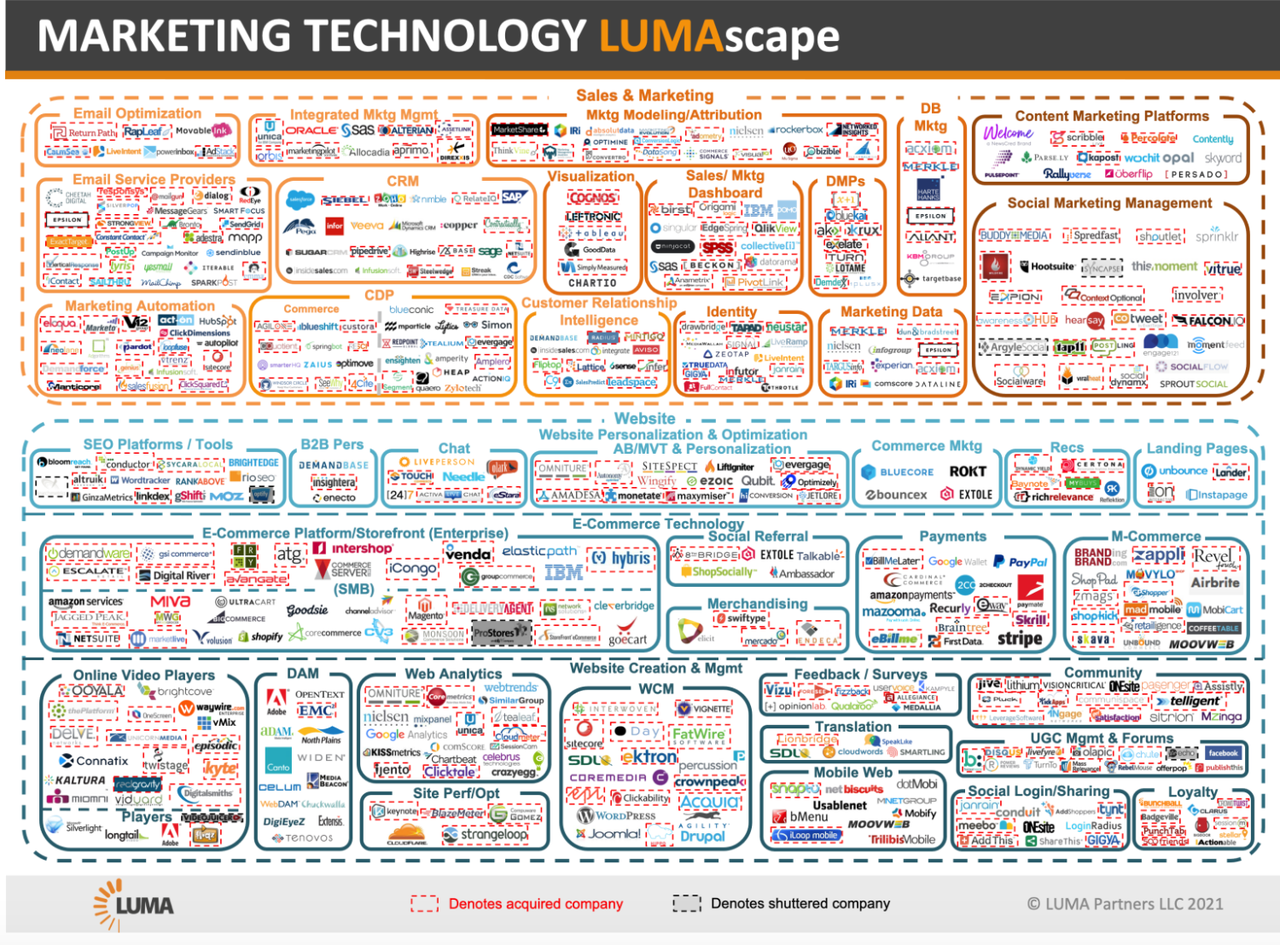

My initial success - as both an operator and investor - was in AdTech, the first enterprise category to truly embrace the potential of Big Data, AI and Marketplaces. In the oughts DSPs began disrupting Ad Networks and forever changed the way media was bought and sold. Up to that point, Ad Networks were essentially bundling audiences and ad inventory before DSPs came along. These new Ad Platforms unbundled the data and the publishers. They provided self-service access to components within media that enabled enterprises the ability to easily target, optimize and price. This is essentially what’s going on with these new data-driven healthcare platforms, particularly at the enterprise level.

Over 155 million Americans get their health insurance through their employer. The overwhelming majority of these employer-based health insurance plans are self-insured, where the employer takes on the risk of providing health insurance coverage for their employees. Roughly 80% of companies with more than 500 employees provide their own insurance plans.

Enterprises as self-insurers are functionally insurance companies without any of the attributes common to actual insurance companies, i.e., networks of providers, claim processing functions, etc. To carry out these functions these employers outsource the job. Whether it’s Oxford, Cigna or Blue Cross Blue Shield, large insurance companies usually take on the administrative role for these self-insured plans and essentially source relationships and partnerships to create networks of providers and solutions that enterprises can then offer to their employees.

It’s all provided as a bundled brand solution with little to no transparency, just as Ad Networks once did when they brokered publisher media to brands.

An Ad Network’s media plans - like traditional health care plans now - were opaque by design. DSPs and programmatic platforms changed all that through transparency and automation, enabling brands direct access to media and the ability to manage it.

In that same vein, these new healthcare platforms use data and automation to integrate medical data, providers, and program utilization across the healthcare system. Just as it was with brands and publishers, employers and employees are now able to hone in on the particulars of a given offering and optimize based on quality and price.

Enterprises can now effectively analyze years of cost data to provide a band around the low and high-end of potential costs. This data provides points of interaction which platforms can then use to surface the best health path from a cost and quality perspective for employers and employees. It’s a more personalized, lower-cost way to still get the quality-of-care that addresses individual needs without the annualized raise in health care costs common to most health plans.

“The way we access, pay for, and improve healthcare in the U.S. is undergoing a fundamental shift—one driven by employers,” said Ali Diab, CEO and co-founder of Collective Health, on the heels of $110 million fund raise in 2019. Collective Health is perhaps the most well-known of these new platforms transforming these legacy systems and providing innovative approaches to delivering care. Others, ike Flume Health, Apostrophe and Eden Health, are also tackling services and support for companies looking to unbundle healthcare.

The challenge for investors analyzing these new platforms is targeting which ones will eventually emerge as the heath vertical’s version of the AdTech unicorn in the same manner in which, say, TradeDesk did (currently at a $30B market cap) when it first disrupted AdTech. (Full disclosure: my VC firm was an early investor in TradeDesk.)

There are several important lessons to be gleaned from this AdTech analogy as more and more of these platforms emerge. Data is the glue that binds, whether it’s a marketing stack or a platform telling you where and how to access care. A solid understanding of where and how data originates and what that data is really telling you is vital. Today’s marketers can go pretty far in the wrong direction with an ill-informed strategy that relies on bad data. Bad data in healthcare could be disastrous.

And then there’s the idea of market buy-in. A decade ago the market almost universally bought into what new Ad Platforms offered. Any reluctant players eventually (grudgingly) got on board or were simply obviated. It’s less clear if that dynamic will play out in the same way with health care.

I spoke with Cedric Kovacs-Johnson, CEO of Flume Health, which uses data to build and run health plans for enterprises independent of any large carrier. “The challenge,” he said, “is figuring what pieces to build in, how to operationalize and manage them and how to make those pieces highly relevant and consumable to a potential member.“ He added, “The thing that keeps me up at night is the idea that carriers and health systems with market share refuse to integrate.”

Our employer-based approach to providing health insurance has been called an accident of history. Yet, even its success to date in covering employees has always been limited.

The hallmark of technological innovation in AdTech was the application of data/AI with respect to automated workflows, analytics and the creation of new marketplaces. Utilizing the same lessons learned from AdTech, these new platforms are now transforming what is possible with healthcare.

The AdTech revolution a decade earlier demonstrated the importance of supply/demand, automation and the connectivity between enterprises and end-customers. Given that employers pay for roughly half of all private healthcare in America it’s not exactly surprising that they are also pioneering the most innovative approaches to delivering care. With such a massive potential market, the application of data and automation across healthcare is helping to create huge opportunities for a new generation of SaaS platforms that can eliminate fragmentation and inefficiencies while (most importantly) lowering costs and improving healthcare services for American employers and workers. It seems inevitable that those in the health insurance sector who ultimately don’t embrace these changes will likely face the same fate as Ad Networks did a decade earlier.