Recommerce, peer-to-peer or secondary marketplaces have been a wave that has taken the consumer market by storm over the last 5–10 years. Although this market’s existence dates back to the days of Ebay, Craigslist and other dinosaurs, recommerce has taken off through more modern platforms, many of which are now unicorn companies. These platforms enable consumers to sell products from any brand directly to other consumers online while managing a lot of friction including discovery, authentication, logistics and customer service. Some of these platforms focus on specific categories like shoes, streetwear or jewelry while others are more specialized based on geography or product price. Some large ones that my peers and I actively use include: StockX, GOAT, thredUP, Grailed, The RealReal, Etsy, Poshmark, Mercari and more.

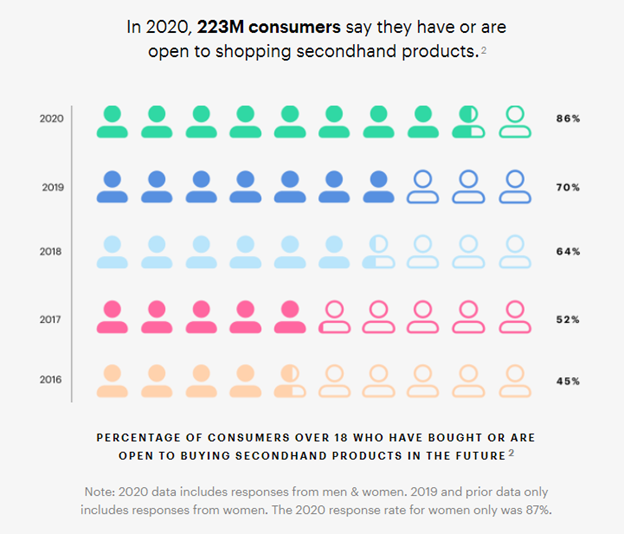

Source: thredUP

The sneaker and streetwear resale market alone has grown to over $2 billion in North America, growing over 20% each year with the potential to reach $30 billion globally by 2030. Meanwhile, the global hard luxury (watches and jewelry) resale market is ~$25 billion and growing rapidly at 8% each year as well. These are only portions of the peer-to-peer resale landscape and encapsulates how this market has grown to be an entirely independent space poised to continue to heavily impact the way consumers think about buying products. COVID has played a big role in the accelerated adoption of ecommerce in general and this extends to the recommerce space as well.

The fact of the matter is that across most of these horizontal selling platforms, there are some glaring problems that are growing congruently and need to be addressed. Now that there are signs of meaningful scale in this market, it is becoming clear that massive businesses can be built to service this market and its individual stakeholders including brands, sellers, buyers and the marketplaces themselves. I am calling this market the recommerce enablement market. Below are a few examples of problems that early-stage companies are trying to solve for different market constituents in the initial wave of recommerce enablement.

Brand Ownership

The brand’s involvement in resale has been limited at best historically. If you were to ask a sales executive at a top brand ten years ago whether they would consider selling used products, you would get laughed out of the room. Times and priorities have changed. Good brands are more sophisticated and now understand that peer-to-peer selling is a core buying channel of the future for consumers and they need to get involved.

As it stands, the peer-to-peer marketplaces are a complete black box to brands of all sizes. As more and more product sales happen in these marketplaces, there are three key problems that arise for brands:

1. Data. The brands collect no data at all on these transactions. They have no idea which of their buyers are now selling their product and have no data on the buyers of the second-hand products. They also do not know what products are selling or where they are selling from a marketplace or geographic standpoint. This data could empower brands from a sales and marketing perspective as well as for product and inventory decision making.

2. Customer Experience. With the black-box effect of the marketplaces, brands also lose all control over customer experience. For example, if you bought a Nike product that was listed as “like new” on one of these marketplaces and it came stained and torn, it would likely cause your brand association with Nike to take a hit. In this case, the brand genuinely has no control over product condition, sales process, pricing or delivery timeline. Given the importance of all of these steps for a brand, this can become a major problem if a meaningful percentage of total sales happen on these peer-to-peer marketplaces.

3. Revenue. This may be the most glaringly obvious problem that brands face. Individuals are selling a brand’s products to buyers and the brands do not get any incremental revenue in the transaction. Although there is an argument to be made that the product was already bought outright when the brand initially sold it, brands would ideally be able to participate in the resale of the product as well.

These issues that brands are facing are only getting larger as the horizontal peer-to-peer marketplaces grow in influence and market share. Brands have now been forced to think more openly about resale as a means of selling product alongside their new product offerings. As brands determine how exactly they want to incorporate resale, there are a fleet of startups that are trying to assist them.

Early stage companies such as Recurate, Archive and Treet have all identified the pain brands were facing and are now providing an innovative solution. Although they all have their own nuances, these companies provide an out-of-the-box branded recommerce marketplace for brands to host either on their own website as an exchange or linked to their website as a branded virtual consignment shop. Ecommerce retailers of any size can launch with one of these providers and have their own vertical consignment shop where previous buyers of their products can buy and sell products to existing or new customers. The brands mitigate all the identified problems with these platform partners. They can maintain quality control and customer experience, collect data on all marketplace constituents and sales as well as collect incremental revenue on the transactions themselves.

As resale continues to scale, more and more problems will come up for brands, but these companies are already proving that there is a large opportunity in solving resale marketplace issues for brands going forward.

Seller Enablement

With the dramatic increase in buyer traffic on recommerce marketplaces, the world of full-time prosumer sellers has emerged in a meaningful way. As an individual or small team, you can build a profitable business by systematically buying new and used product and selling it across all the pertinent horizontal marketplaces. Marketplace listing and management poses specific problems for sellers as they continue to structure and formalize their processes.

The marketplaces attempt to make it abundantly simple to list, manage and sell on their platform; this is one of their key drivers of success. What becomes more complex is the process of selling concurrently across multiple marketplaces. Pro-sellers must manage listings of a single product including photos, pricing and tagging across multiple marketplaces and be sure to delist a product that has been sold on one marketplace from others. Although this is doable for a concentrated number of products, once you begin to scale as a seller, this becomes a top-of-mind issue. Products like Hammoq are alleviating some of these issues for pro sellers by creating a unified selling platform that automatically manages a single product listing across multiple marketplaces with a single source of truth. This reduces the manual burden on a seller dramatically and enables them to take on more business.

Less sophisticated sellers have their own set of problems. Most sellers on peer-to-peer marketplaces do not sell for a living and therefore do not have the expertise or time to optimize for listing quality, price and selling across multiple marketplaces. Meanwhile, pro-sellers are always looking for new sources for business and products that they can sell, especially when they do not have to front the cost. Early-stage businesses like Flyp help solve this problem for regular and pro sellers by providing an easy way for regular sellers to match with a pro who is then tasked with selling the product. The pro gets incremental revenue without baring the inventory or acquisition cost while the regular seller eliminates the burden of manually attempting to list and sell the product.

Product Authentication

Authentication may be the most pervasive and expensive problem in peer-to-peer selling. The value of imported fake goods worldwide is over $500B and growing with key categories including footwear, clothing and leather goods. With a sophisticated shadow market for manufacturing and distribution, counterfeit product is spread throughout the marketplaces and the burden of maintaining authenticity falls on the sellers and the marketplaces.

The marketplaces maintain seller control by having feedback loops with buyers to rate the product and buying experience. If the buyers identify a product as counterfeit, the platform can banish the associated seller from their platform. Outside of buyer feedback, the marketplaces must spend meaningful capital to maintain quality control. For example, designer shoe marketplaces such as StockX and GOAT hand authenticate every sold product on their platform before sending it to a buyer. That means that they need to maintain warehouses and staff so that when a seller sells on their platform, they send it directly to a marketplace-operated warehouse. After the authenticator verifies the product, they send it directly to the buyer. This process is extremely expensive and inefficient from a time and logistics perspective, but it is the only way the marketplaces have solved for the authentication problem.

Early-stage companies like Suede One are helping solve this marketplace authentication problem by providing their authentication API to marketplaces. This API allows marketplaces to embed a third-party entirely photo-based authentication solution directly into their process, reducing the need to spend money on self-operated in-person authentication. Their authentication process uses a combination of computer vision and a marketplace of expert authenticators to efficiently provide an authentication verdict and stamp of approval for their clients without ever physically touching the product.

When it comes to luxury and collectibles marketplaces, buyers and sellers have the additional burden of maintaining and authenticating their own collections. Companies like Magpie allow product owners to authenticate, track and value collections as well as verify transactions utilizing digital assets for collectibles. Reducing friction caused by authentication is a key factor in maintaining or increasing the comfort level of consumers with peer-to-peer marketplaces generally.

Recommerce has exploded and will continue to explode in the coming years. Buying used and new product from peers or directly from brands will begin to merge into a unified experience for the consumer. With this in mind, businesses with enormous potential are being built to service the recommerce industry as it begins to take flight.

Although these startups are solving some essential problems for recommerce constituents, they are only scratching the surface of what is required to maintain or increase the growth in recommerce adoption. Some areas where I believe there is untapped opportunity in recommerce enablement include the following:

Consolidated Buyer Experience — Similar to what Hammoq is providing for pro sellers, there is fundamental inefficiency in buying products across multiple platforms. For example, as a consumer it causes a lot of purchase friction to look for the same pair of shoes across StockX and GOAT. Although some of this can be solved with market consolidation, as recommerce platforms continue to proliferate there will be an opportunity to create a layer on top that provides a unified view of the market from a single source of truth for the buyer. I am unsure how or when this will materialize but it is a natural step for this market.

Product Insurance — This is a natural extension of upstart authentication providers like Suede One. Once a company can build the right equation for market-wide authentication at scale, it is possible that they could flip the model on its head and provide insurance on products this way. This could be provided by a third-party authentication provider directly or through a recommerce marketplace partner. There are a lot of ways this could be surfaced to the consumer. Imagine in the purchase flow on StockX being able to staple on a nominal product authentication warranty package powered by a third-party authentication platform.

The startup world is only starting to explore the potential for building businesses to help fortify the recommerce industry and there is a lot of room to build. I am excited to see what other problems recommerce enablement founders find and solve as the industry continues to scale.